Following the two-year implementation, NBU Strategy 2025 was revised in 2023 in the wake of the full-scale military invasion by russia.

In 2021, the NBU developed its second institutional Strategy, which covered the period through 2025. The Strategy focused on creating maximum value for customers, meeting today's challenges and contributing to the cutting-edge development of the Ukrainian financial sector regulator.

The NBU Strategy is a road map for the central bank to achieve its goals within its own Mission, Vision, and Values.

Well-balanced mix of products, factoring in the needs of all customer groups, created and supplied to the financial ecosystem is the key to fulfilling the NBU’s Vision and Mission on a daily basis.

The NBU Strategy set a range of manageable priorities.

The document was consistent with the principles and areas of the financial sector’s development, as set forth in the Strategy of Ukrainian Financial Sector Development Until 2025, which consolidated the vision of development of all participants of the financial ecosystem.

The NBU was striving to ensure that financial sector regulation stimulated economic development and addressed the current challenges in the environment as well as the needs of all ecosystem participants. Each item of the Strategy was in line with these aspirations.

Initiatives that were not completed in 2021–2022 were analyzed and, if necessary, updated and included in the new institutional Strategy.

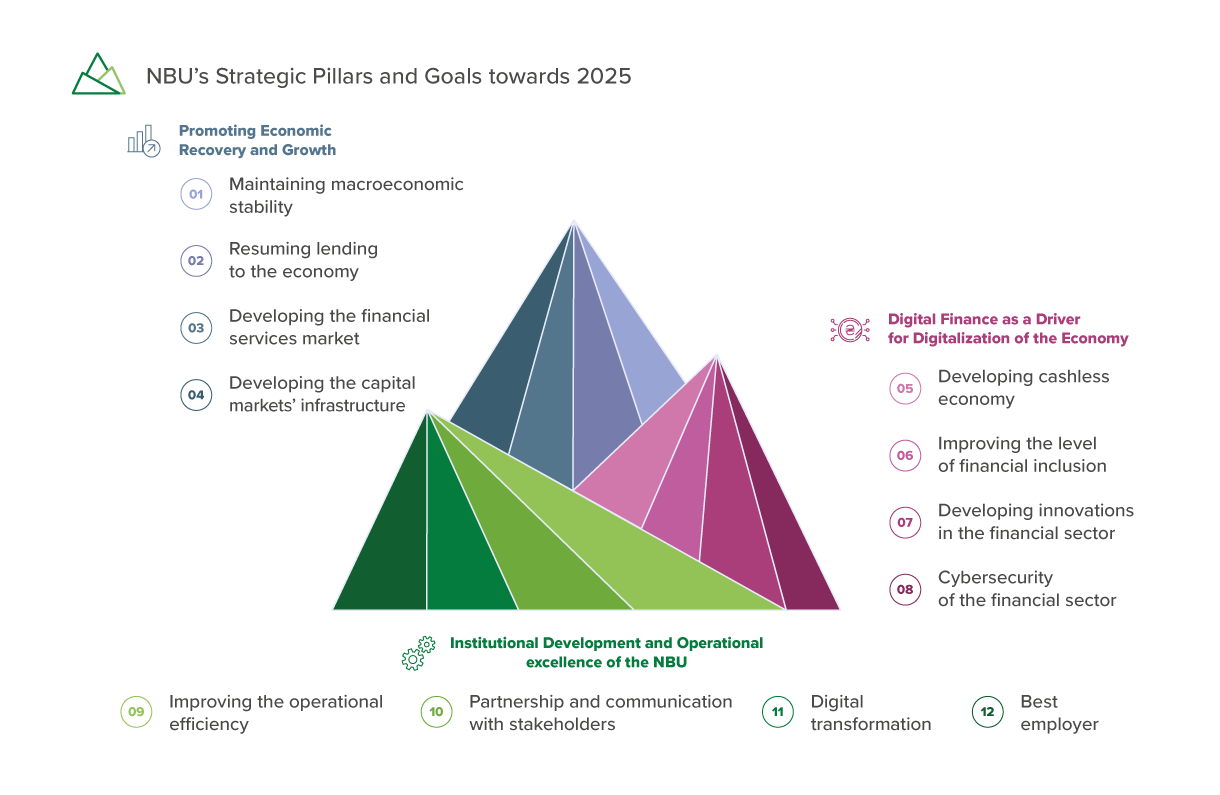

In 2021–2022, the NBU’s overall progress in implementing its strategic goals was 56% (based on the progress in implementing strategic measures). This was only 5 pp lower than planned. The best performance was recorded in Pillar 1. Promoting Economic Recovery and Growth – 62%. The progress was 55% for Pillar II. Digital Finance as a Driver of a Digitalized Economy, and 44% for Pillar III. Institutional Development and Operational Excellence of the NBU.