The National Bank of Ukraine (NBU) designed the Comprehensive Program of Ukrainian Financial Sector Development Until 2020 to achieve the sustainable development of the financial market in 2015-2019 years. We were reforming Ukraine’s financial system to liberalize financial markets, create equal competition, overcome the consequences of the economic crisis, and harmonize markets.

The program’s main objective was to build a fully-fledged, efficient, and effective financial market in Ukraine; to develop all segments of the market; to build market infrastructure; and to strengthen the market’s resilience to external threats.

The comprehensive program was a joint reform program developed by

- The National Bank of Ukraine

- The Ministry of Finance

- The National Securities and Stock Market Commission

- The National Commission for the State Regulation of Financial Services Markets

- The Deposit Guarantee Fund

- Professional associations in the financial sector such as the Independent Association of Ukrainian Banks and the Ukrainian Insurance Federation

- Leaders of parliamentary factions in the Verkhovna Rada of Ukraine

- Financial market experts

The program met the requirements of or was in-line with:

- The Ukraine 2020 Sustainable Development Strategy

- The Association Agreement between Ukraine and the European Union

- The Memorandum of Cooperation with the International Monetary Fund

- The parliamentary coalition agreement by the European Ukraine parliamentary factions

The Comprehensive Program of Ukrainian Financial Sector Development Until 2020 was developed in 2015 and updated in 2017 and in 2018.

Streams of the Comprehensive Program

- Removing non-viable and non-transparent institutions from the financial sector

- Transforming financial sector regulators to harmonize financial markets

- Introducing mechanisms for the resolution of bad debts

- Protecting the rights of investors and consumers

- Harmonizing the taxation of financial sector instruments

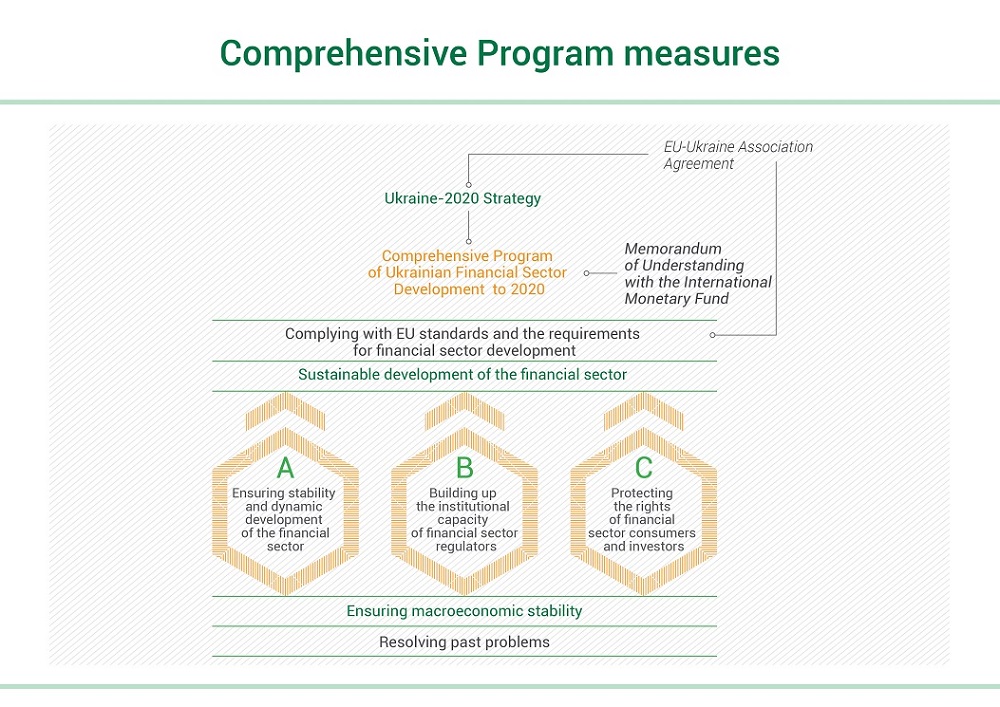

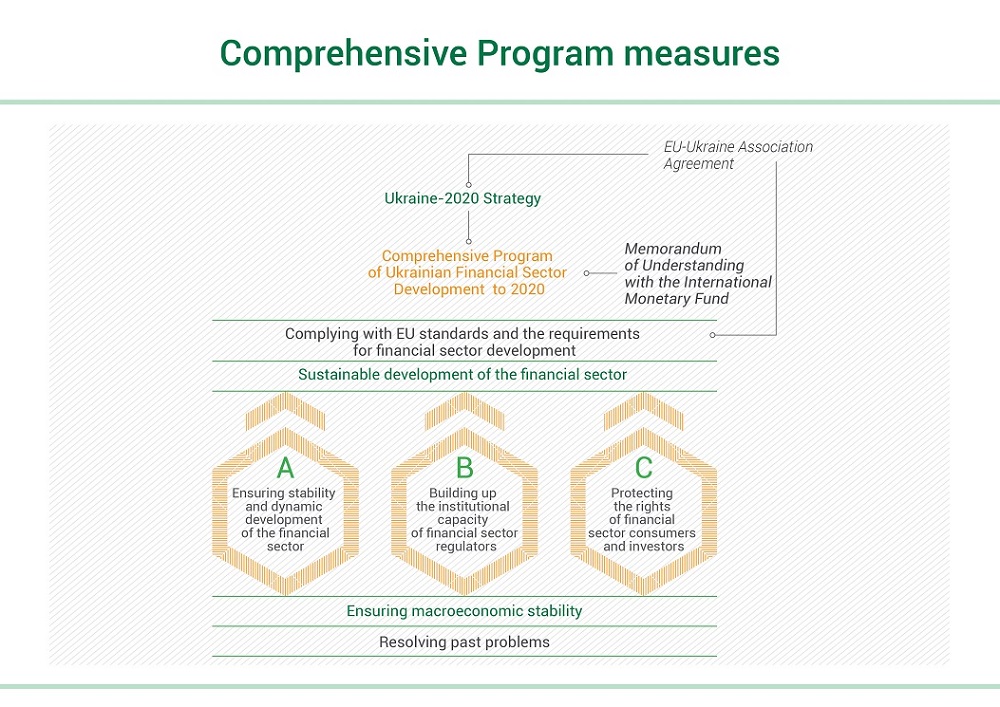

Infographic description: Comprehensive Program Measures

This infographic illustrates the structure and priorities of the Comprehensive Program for the Development of Ukraine’s Financial Sector up to 2020, in alignment with international and EU agreements.

At the top, three policy documents are listed as the program’s foundation:

- Ukraine–2020 Strategy

- EU–Ukraine Association Agreement

- Memorandum of Understanding with the International Monetary Fund (IMF)

The goals of the program include:

- Complying with EU standards and requirements for financial sector development

- Ensuring the sustainable development of the financial sector

The core areas of focus are represented by three labeled hexagons (A, B, C):

- Ensuring stability and dynamic development of the financial sector

- Building up the institutional capacity of financial sector regulators

- Protecting the rights of financial sector consumers and investors

At the bottom, the infographic highlights two overarching outcomes the program seeks to achieve:

- Ensuring macroeconomic stability

- Resolving past problems

The entire chart is structured top-down to emphasize the logical flow from strategic vision and international alignment to practical reform objectives and expected results.

The program was implemented in three stages through more than 50 projects that were part of the roadmap.

The NBU was fully engaged in drafting legislation aimed at overhauling the financial sector and spurring its rapid development.

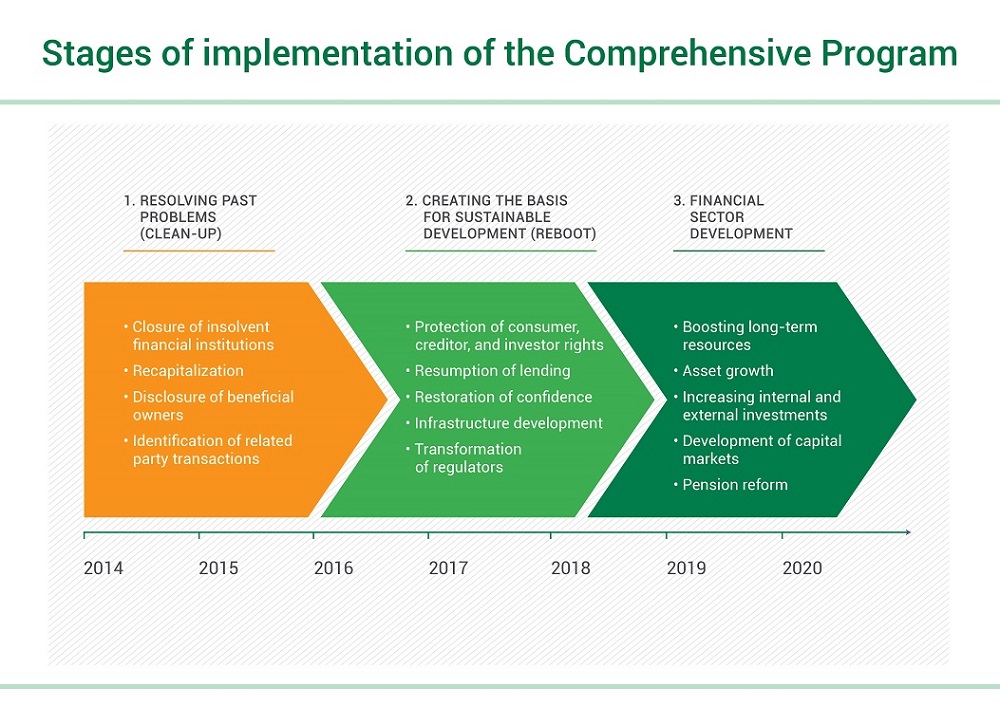

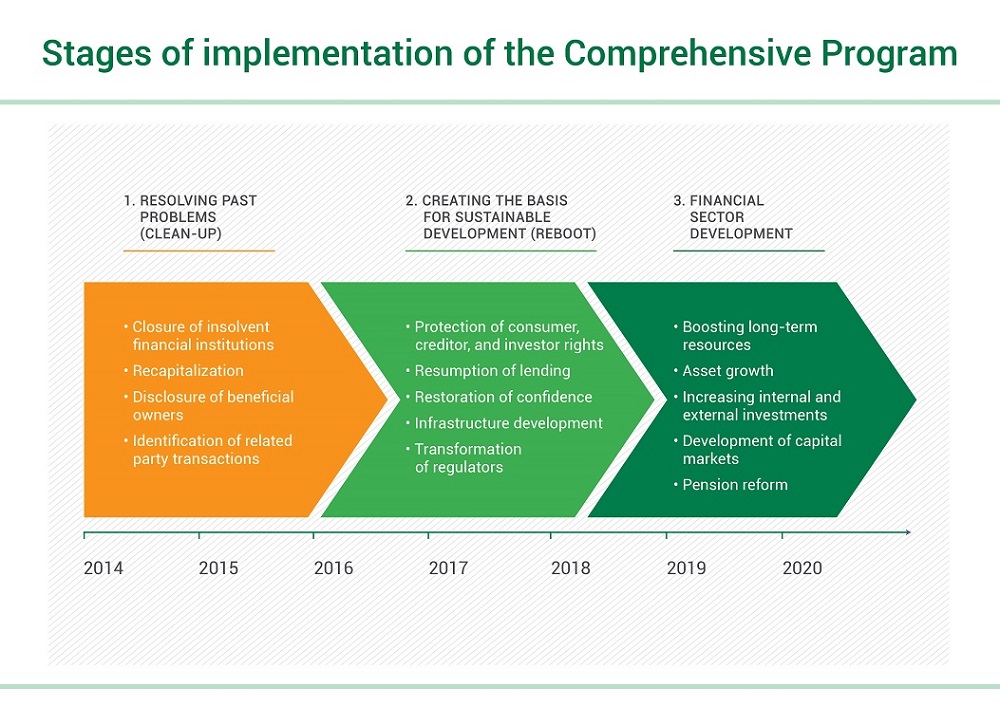

Infographic description: Stages of implementation of the Comprehensive Program

This infographic presents the timeline and structure of reforms under Ukraine’s Comprehensive Program for financial sector development from 2014 to 2020. It is visually divided into three color-coded sequential stages, each shaped as an arrow pointing forward, aligned on a horizontal timeline.

- 1. Resolving Past Problems (Clean-up), 2014–2016

- Closure of insolvent financial institutions

- Recapitalization

- Disclosure of beneficial owners

- Identification of related party transactions

- 2. Creating the Basis for Sustainable Development (Reboot), 2016–2018

- Protection of consumer, creditor, and investor rights

- Resumption of lending

- Restoration of confidence

- Infrastructure development

- Transformation of regulators

- 3. Financial Sector Development, 2018–2020

- Boosting long-term resources

- Asset growth

- Increasing internal and external investments

- Development of capital markets

- Pension reform

Each stage builds on the previous one, showing the progression from crisis resolution to rebuilding and forward-looking growth of the financial system.

The progress in implementation of the Program is acceptable, considering the complexity of the challenges faced by regulators. In general, two-thirds of all Program activities have been fully completed or completed by at least one responsible regulator. The remaining tasks will be implemented within the framework of the Strategy of Ukrainian Financial Sector Development until 2025, which was presented in January 2020.

Successful implementation of most of Program’s tasks has helped to solve a number of economic problems in Ukraine accumulated during previous years, and restore macroeconomic stability in the country after the 2014-2015 crisis.