Every quarter, the NBU prepares its economic forecast and publishes it in the Inflation Report. The report contains a lot of useful information, but is primarily intended for professionals. This web page was created to make it easier for anyone to learn about major economic events and the NBU’s vision of the future development of the Ukrainian economy.

How is the economy holding up?

Despite the war and this year’s decrease in crop yields, Ukraine’s economy continues to recover. russia’s attacks on the Ukrainian energy infrastructure in the summer slowed economic growth to a certain extent, but did not bring it to a halt. Thanks to quick repairs, electricity imports from other countries, and the domestic generation capacity, Ukraine managed to avoid the worst-case scenarios. The state, businesses, and households have been quick to adapt to new challenges, which greatly helps to keep the economy afloat.

International assistance continues to be an important source of support for the economy. In 2024, Ukraine is expected to receive more than USD 41 billion in assistance from international partners. Thanks to these funds, the government will be able to finance social spending (pensions, salaries for educators and healthcare workers, various types of benefits and more) and reconstruction projects. This, in turn, will support consumer demand for goods and services and encourage businesses to invest in their projects.

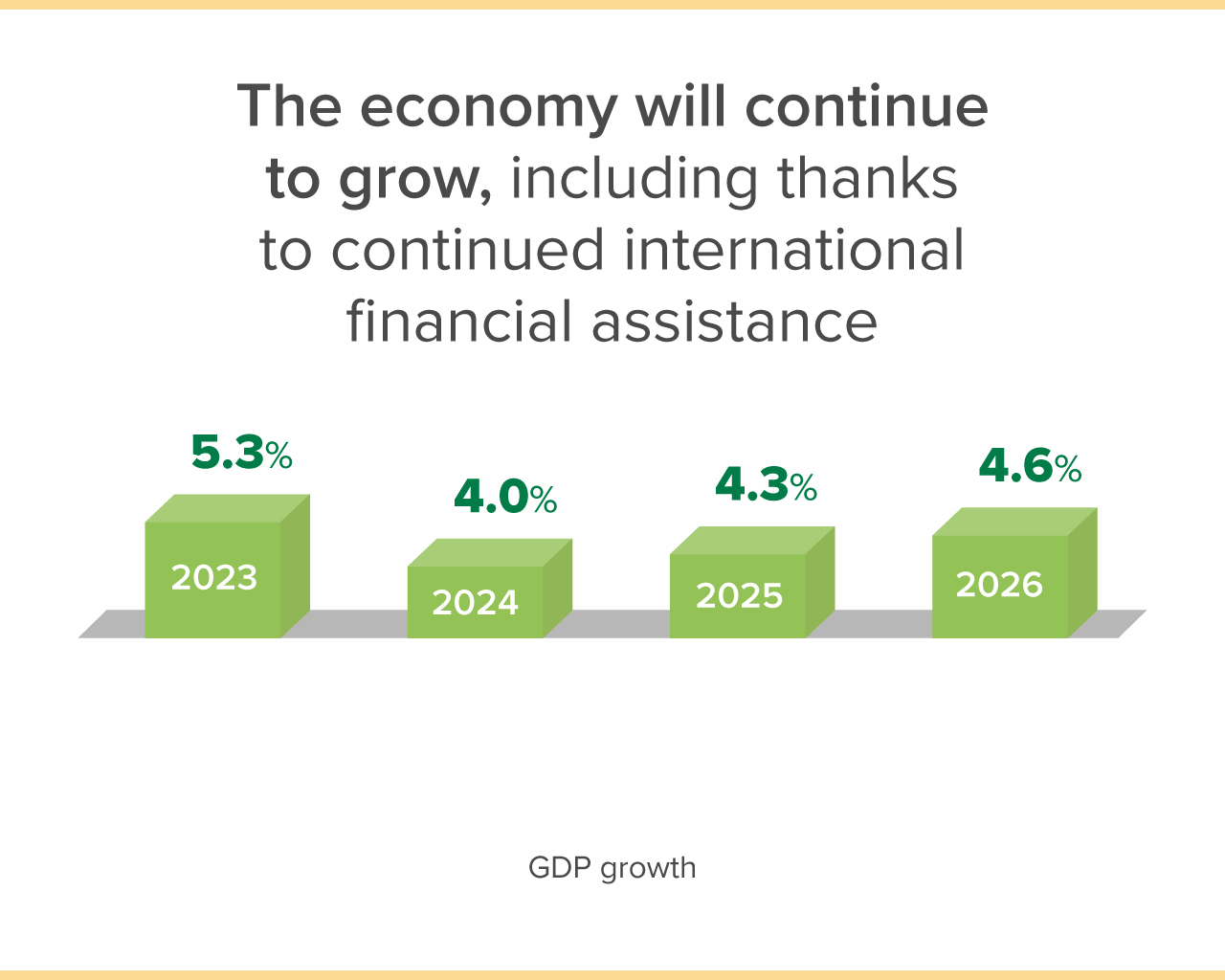

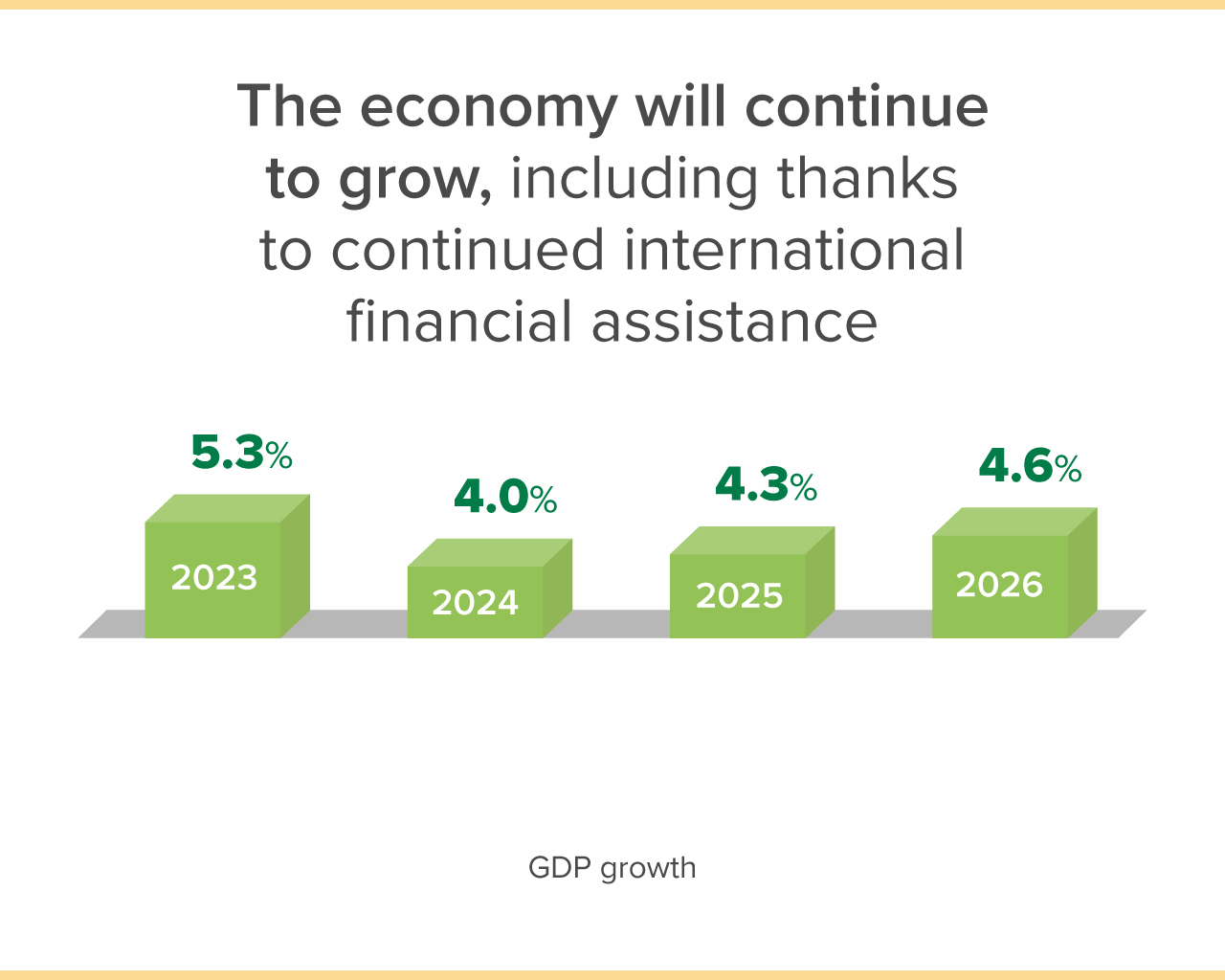

The NBU expects the economy to grow by 4% this year. The economic growth may even slightly improve in the coming years. It will continue to be facilitated by significant budget spending on social programs, reconstruction projects, and defense capability, including the development of the defense industry. In addition, the expected global economic recovery will increase other countries’ demand for Ukrainian goods. The recovery will be further supported by Ukraine's active European integration.

Without a doubt, the economic development strongly depends on the support provided by international partners. The NBU expects their support to continue. In particular, more than USD 38 billion in financial assistance is projected to be raised for Ukraine next year. Ukraine will also start receiving proceeds generated from immobilized russian assets in Western countries. The NBU estimates that these funds should be sufficient to address the state's urgent needs.

What will happen to jobs and wages?

Business surveys indicate an acute shortage of workers due to migration and military mobilization. The number of vacancies offered by the businesses has been growing steadily. This is particularly noticeable in cities such as Kyiv, Lviv, and Dnipro. At the same time, it is difficult to find qualified employees. Businesses of various types complain about the shortage of workers. The blue-collar, services, and retail industries struggle the most to find workers.

Due to personnel shortages, business competition for qualified staff specialists is growing, which is reflected in the further increase in salaries. According to the latest data, in the summer, average salaries were higher by about 22% yoy. The current wage growth rates significantly outpace inflation, which means that they more than compensate for the increase in prices for goods and services.

Given the impact of the war, a significant personnel shortage will persist for a long time. On the one hand, this means that wages will continue to grow quite rapidly. On the other hand, labor shortages will slow down economic development and trigger higher inflation. Staff shortages will ease as the security situation improves, particularly due to the gradual return of migrants to Ukraine as well as the reintegration of demobilized veterans into civilian life.

What about prices?

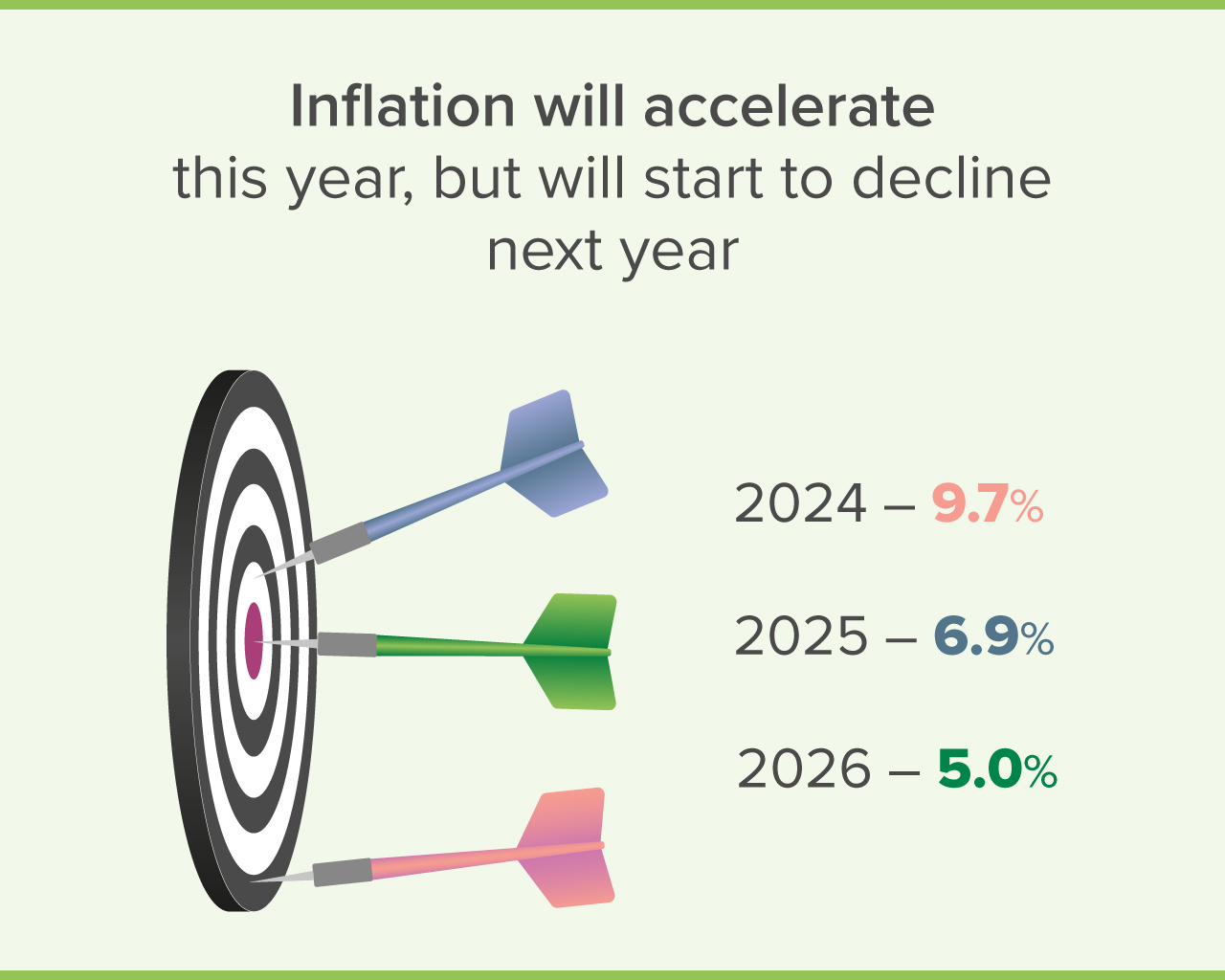

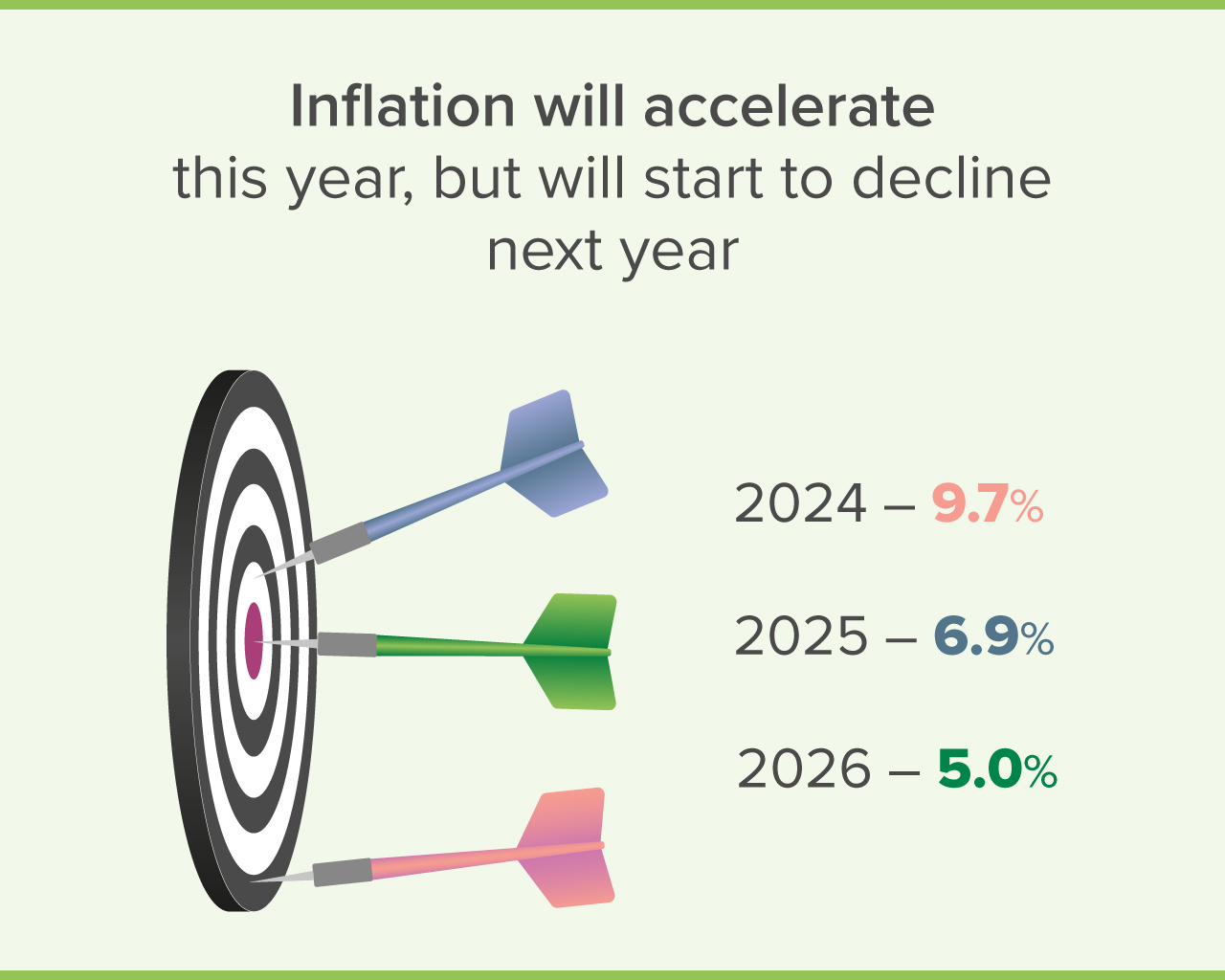

Consumer prices have been rising in recent months, although this trend was expected. In particular, in October, inflation reached 9.7% yoy. This indicator is an average, as prices for different goods and services changed in different ways. Prices of some goods (e.g., dairy products and vegetables) rose faster than prices of other goods (e.g., cereals and chicken). Prices for some goods and services remained unchanged (gas and heating tariffs) or were even slightly lower than last year (pork, sugar, clothing and footwear).

Several factors contributed to the rise in inflation. In particular, there has been a decrease in this year's crop yields. As a result, food prices grew at a faster pace. In addition, the rise in prices is significantly affected by the war. Specifically, electricity prices have increased due to damage to power generation facilities. Due to labor shortages, businesses raise salaries more frequently, which leads to an increase in production costs and prices. Prices were also affected by a certain weakening of the hryvnia exchange rate.

That said, inflation will start to decline in the spring of 2025. To this end, the NBU will take various measures, including maintaining a stable situation in the FX market and preventing strong fluctuations in the hryvnia exchange rate. The increase in crop yields, the expected decline in global energy prices, particularly oil prices, and the improved situation in the energy sector should also contribute to a slowdown in inflation. With this in mind, the NBU predicts that inflation will stand at around 7% next year, and then decline to the 5% target.

How can savings be protected from inflation? Is it possible to take out loans?

In order to maintain the interest of Ukrainians in hryvnia savings, the NBU stopped reducing the key policy rate in July and has kept it at 13%. This also discourages banks from lowering rates on hryvnia deposits. The NBU has also been maintaining stability in the FX market. In recent months, the NBU has increased FX sales from its reserves to prevent the hryvnia from excessive fluctuations. The levels of Ukraine's international reserves remain high (USD 36.6 billion at the end of October), therefore the NBU will be able to continue to keep the situation in the FX market under control.

In view of this, Ukrainians continue to invest a significant share of their savings in hryvnia deposits and domestic government debt securities. The volumes of such deposits have been growing steadily in recent months. Currently, bank hryvnia deposits yield on average more than 10% after tax, while investments in tax-exempt domestic government debt securities yield 13% or more. This yield provides protection of savings from being eroded by inflation.

In addition to attracting deposits, banks are simultaneously increasing lending. Many loans were issued to support industry and energy. Banks also increased lending to households, both for the purchase of goods, services, and housing. The revival in lending is important for further economic recovery.